Assessing your property investment strategy…hold, invest, review or release?

What is the core aspect of any property investment strategy?

A core aspect of any property investment strategy is assessing how well the current portfolio meets the business’ needs and where to optimise your capital investment.

Whether you have multiple warehouse requirements, numerous retail outlets or just a few office spaces, there is a simple way you can decide what you should do with the properties your organisation currently owns and where you should invest for the future.

The most important part of this process is to determine what is optimal for your business’s growth, both now and into the future. You don’t want to wake up in five years and be unable to expand your organisation because you didn’t take the time (or have the courage) to assess your needs now.

The easiest way to approach this is first to separate the assessment of the location from the assessment of the actual facilities.

Your Property Investment Strategy Answers These Questions

Here’s what you should be asking yourself:

1. consider the optimal location. Is it close to public transport? Is it easy for staff or your customers to access? Is there parking available? Is it close to infrastructure?

2. how about facilities? Are the amenities going to attract the best staff? What’s the optimal size? Is the space suited to business growth? Do the facilities match your business objectives?

Now that you’ve explored your property requirements, you can create one measure for the quality of your current facility and another for its current location.

How well do they match your ideals?

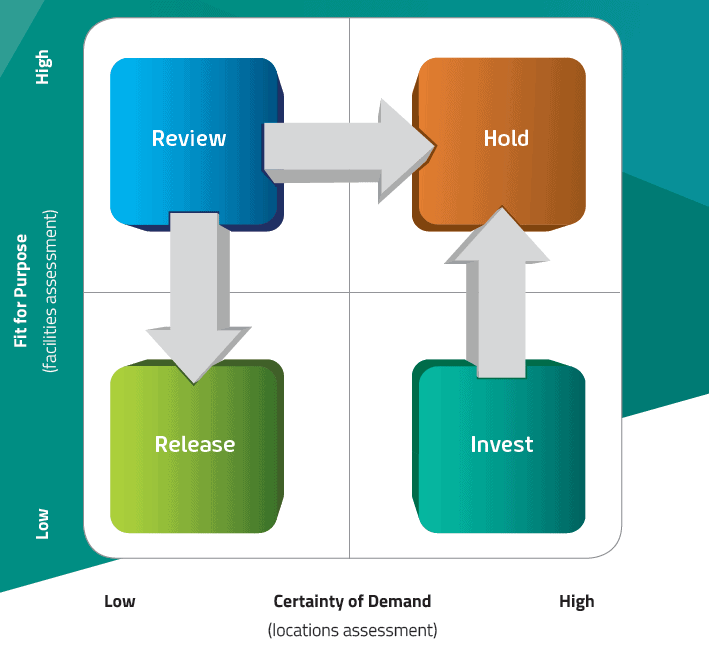

Plot them into a graph like the one below:

You’ll find that each property will fall into in one of 4 areas:

1. Hold: If your sites are in the right location and the facilities suit the current and future needs of your business, hold them and secure tenure.

2. Invest: If your infrastructure isn’t up to scratch but the location is suitable for the next 5-10 years, these properties are worth some prioritised investment and tenure secured.

3. Review: On the flip side, if the facilities are fit for purpose now and into the future, but the location is unsuitable, it is worth reviewing this property before any considerable investment is made. The review will help move the property back to hold or onto …

4. Release: When neither the location nor facilities are fit for purpose into the future, the best step to take is to release the property and source a better fit for your business needs. Sound tough? Your future self will thank you.

Undertaking an assessment of your current portfolio is a simple and practical step towards improving spend and ensuring your portfolio is enabling your business to prosper.