The next generation of property outsourcing – creating value

Property Outsourcing

The traditional model for outsourcing property services is under pressure. Having harvested the initial benefits, many clients are questioning the value that they receive from large, single-sourced relationships.

Organisations are challenging the notion that consolidated contracts with correspondingly large numbers of staff on the provider side are delivering the right level of value. When the cost of an outsourced workforce includes profit margins, many are asking, “Why don’t we just employ the people ourselves?”

This article looks at the challenges faced by property functions with significant outsourced structures and summarises the questions that are now being asked. Finally, we identify areas that the next generation of outsourced contracts need to address if they are to continue to add value.

How outsourcing has evolved

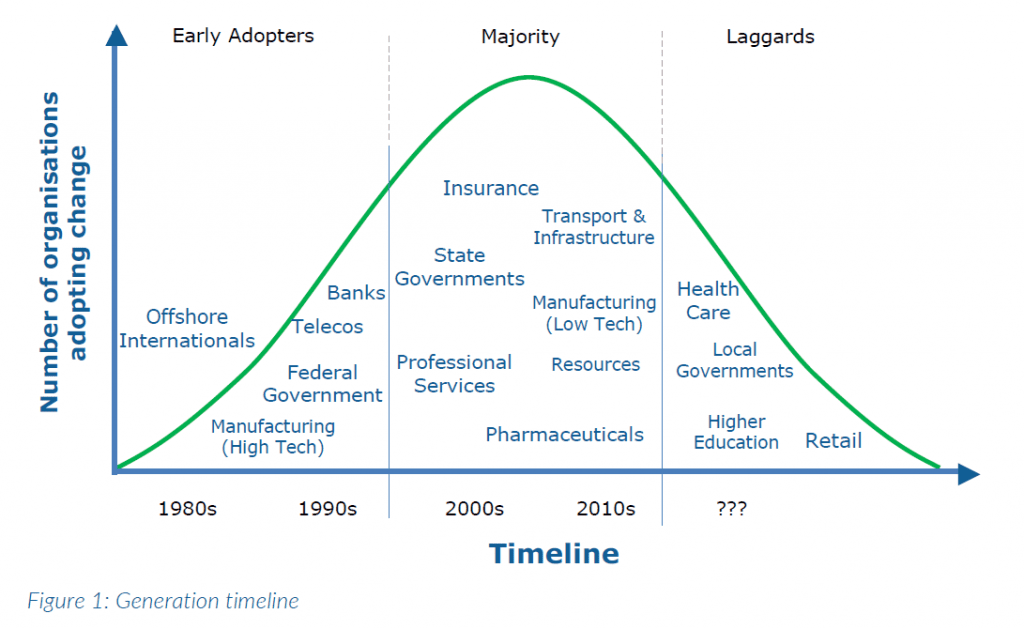

In Australia, the first wave of property outsourcing occurred in the mid to late 1990s. Led by the major banks and the federal government through the sale of the Australian Property Group, a competitive service provider market was founded.

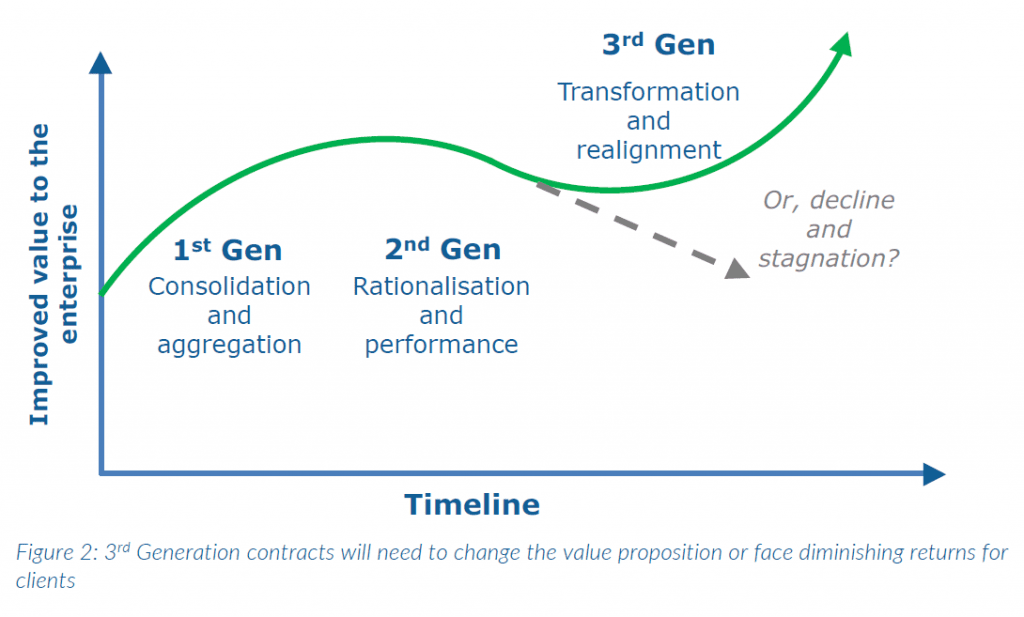

What developed were the first generation contracts which were typically focused on centralising the property function, standardising the services and aggregating spend to leverage scale.

With the benefit of consolidated data and reporting on portfolio costs and performance, organisations were then able to shift their focus to better transactional performance, portfolio rationalisation and improved partnering with service providers and internal clients. Second generation contracts emphasised performance, reporting and partnering to drive value from outsourced relationships.

So where are you placed?

It’s here that a lot of market participants get caught up on the terminology. Are we 1st gen or 2nd or even 5th if we have had successive outsourced contracts?

Our experience has shown that while contracts get renewed, they are not always progressive in their approach.

Similarly, the evolution of performance and focus is not strictly speaking dependant on outsourcing. Organisations can move forward without outsourcing.

It’s just that outsourcing enables performance to evolve by establishing the necessary foundation capabilities. Our experience also demonstrates that:

- the generations are not completely mutually exclusive in that the focus, drivers and strategies can overlap

- organisations may need more than one go at each generation contract before they have the foundations to move onto the next

- the outcomes and capabilities developed are built on, not discarded, as organisations move from one generation to the next

Table 1: 1st Generation versus 2nd Generation

| FIRST GENERATION | SECOND GENERATION | |

| Key themes

|

|

|

| Major changes

|

|

|

| Management focus

|

|

|

The question remains – what’s next?

Many organisations have retendered or renewed contracts using more or less the same structures and model. This could demonstrate a belief that the market is reaching a level of maturity where clients and providers understand the basic contract arrangements, can price their risks and are comfortable with the associated margins.

This belief in the maturity of the outsourced provider market is supported by the consolidation of major service providers to a point where there are a limited number of tier one players.

However, we regularly speak with buyers of outsourced property services who are looking for something other than just ‘more of the same’. Based on our experience across the market, here is what clients have told us is not working under the current models.

Where current contracts fail to deliver value

The dominant contract model aggregates real estate services which are delivered by the service provider’s own staff. Maintenance contracts are managed by the service provider and delivered by specialist subcontractors.

Project management of capitals works can either be delivered by the service provider’s staff or managed as additional subcontracts. The costs of real estate (rents, outgoings, etc.), the costs for subcontracted facilities services and the costs for capital works are all treated as ‘pass throughs ’.

In effect, the client is paying a fee for their property costs and service needs to be ‘managed’ by the service provider. This is what’s called a managed services contract and, in various forms, is the dominant model used in the market.

There are many significant benefits to this type of arrangement which clients continue to enjoy. For a number of reasons, it remains the optimal model for many organisations.

However, there are organisations which believe they have harvested the benefits available under this model and are searching for improved value. These organisations are challenging the following assumptions.

Table 2: The assumptions versus the reality of managed services contracts

| ASSUMPTIONS | REALITY |

| Aggregation will reduce costs

|

Not all costs benefit in the same way from aggregation. In fact many of the cost savings promised by aggregating a client’s spend to others managed by the same provider have been oversold and under-delivered. |

| One provider can do everything

|

With diverse portfolios (retail, commercial, industrial, special purpose) that have a wide geographic spread, getting the best from every service in every location is not supported by having just one provider. |

| Managing one relationship is preferable to having multiple

|

Sometimes keeping a single large provider on track is seen as a more intractable problem than having multiple relationships. This is the case particularly where the desire to ‘get the next job’ drives provider performance. |

| Only a property provider can attract and retain the best property talent

|

Clients have lifted their game and often pay better than the providers. So, why wouldn’t an organisation just recruit the talent themselves? |

Managing the cost of outsourcing remains key

While the industry are keen to sell the greater value of a strategic relationship, for many clients the cost of service delivery remains a constant pressure. With the increasing focus that accompanies the involvement of procurement executives, the fundamentals of aggregated managed-services contracts are being scrutinised for value.

With this focus, outsourced contracts are being criticised for the following.

There’s not enough skin in the game

A managed services provider is seen as ‘all care and no responsibility’ when it comes to the pass-through costs. How can we better share the risk/reward of delivering improved value?

Best in class versus satisfactory at everything

A managed services provider needs to be a property management generalist. Would a better outcome be delivered if a specialist was used for discrete services?

Insufficient competitive tension

When a single provider is appointed for a number of years, they are effectively given a monopoly. How can better competitive tension, particularly for typical transactional real estate services, be created to ensure the best deals are done in every instance?

Addressing these issues, while not losing the benefits gained from first and second generation arrangements, is the challenge.

Third Generation property outsourcing

Change is the only constant. Doing the same thing over and over will inevitably lead to diminishing returns. So it is the same for major outsourced property relationships.

From our experience, we believe that these contracts, like many business models before them, may actually be following a typical product life cycle (Anderson & Zeithaml, 1984)1.

Third generation contracts will need to change the value proposition or face diminishing returns for clients.

The question is, ‘What will the next generation of outsourced contracts looks like?’ To answer this, organisations need to assess their needs across a number of concurrent frameworks.

Our experience has shown that each organisation will develop its own response.

Some will choose the less risky option of ongoing improvement based on the current model. For others, we have provided a synopsis of the key considerations that should form part of their review and assessment framework.

Revisiting of the ‘make or buy’ decision

Clearly there is opportunity to reassess which services are delivered in-house and which will be better delivered through outsourced providers. Contracting services is about accessing skills, knowledge, technology or scale that is not available to an individual organisation.

Outsourcing to a ‘body shop’ will increase cost by a necessary profit margin. Look carefully at what you are getting for these costs and lock in agreement to benefits where you can.

Separate process from knowledge based tasks

A lot of property operational activity is process based. That is, it is the same each time and fairly generic. These processes are scalable and able to be leveraged. Clients should start to think of ‘process outsourcing’ for their property needs as HR, IT and shared services operations have done.

By looking at tasks that are process orientated rather than knowledge-based, organisations can better define where external providers are delivering either process or knowledge capabilities. In turn, the nature of what should be outsourced and how that adds value will become clearer.

Leverage internal expertise

The capability of other corporate resources, and in turn their providers, needs also to be considered. In particular procurement, legal and IT capabilities that are part of the organisations’ own skill set should be considered and measured against those proposed by external providers.

Inject competitive tension

While service providers will argue that good long-term relationships deliver the best outcomes, they also run the risk of complacency. Nothing drives performance like the need to demonstrate value to win the next job.

This is particularly the case for transactional services where performance-based agreements have consistently delivered value to clients.

Realign the internal team

If the nature of what or how outsourcing is delivered changes, so too must the internal function. Too often the skills and capabilities of internal teams are not considered when performance improvement is focused on the contracted elements.

Contract management, relationship management, communication and strategic thinking are the skills that are most often needed on client side.

Assess the spread and range of your property

Property firms separate their teams into traditional commercial, retail and industrial sectors. Similarly they will further specialise specific types of property (bulk retail vs shopping centres) and geographies (CBD and suburban).

Organisations should do the same as different estates within their portfolio will have different needs and therefore may suit different service delivery and contract models. This may lead to parts of the portfolio being better serviced internally or through a more specific contract arrangement.

Residential portfolios and non-corporate investment or land sites are obvious examples.

Understand how technology supports your property strategy

Technology, and how it is deployed to support service delivery, is possibly the most important factor in deciding what type of property outsource contract model organisations choose.

Large service providers are still able to leverage their substantial investments in this area. However, like aggregation of costs, service providers’ systems capabilities have too often been oversold.

A review of functionality and an honest assessment of the strengths and weaknesses of what the market can (and, by definition, cannot) guarantee should be undertaken.

Where to from here?

While the journey to improvement will differ for all organisations, there are some key actions that will significantly improve your chances of moving to the next generation of performance.

1. Understand where you are now

Conduct an honest and thorough assessment of your current strengths and weaknesses. (Grosvenor has developed a CRE assessment framework which may assist.) Make sure you have built the foundation capabilities and exploited the full value of the current model before considering a change.

2. Understand what your customers need

Never assume you know what customers want. Take the time to ask them and ensure you engage at multiple levels to understand the strategic and operational issues and how property contributes value to every part of the business.

3. Understand the value that service providers can (and cannot) deliver

Within the context of your business needs, what value can you leverage from external providers? What mix of generalist and specialist do you need? Is it different for different types of property within your portfolio? How will aggregation benefit and where does MIS fit into your service delivery strategy?

Start a conversation about where you want to go – you will need to identify the right stakeholders and bring them along if you expect changes to be supported. It may be clear to you what needs to change and what improvements are possible, but is that understanding shared? And finally …

4. Have a plan

We advocate for a project approach to any review or assessment that may result in change. Understand the key timelines and milestones, thinking about communication and engagement and development of a governance model that engages senior management to act as sponsors and advisors.

Planning will help you communicate and will assist greatly in developing the momentum required to effect changes you want to make.

So is it time to insource?

Traditional managed service models have a lot going for them. The ability to leverage technology investment and, through outsourcing operational functions, focusing the internal team on customers and strategy are but two.

However, for those who have exploited the full benefit of generation one and two contracts, a reassessment of what is outsourced, under what models and to whom, will challenge the value of large, single-provider relationships.

For them, it may not be time to insource. But it is certainly time to revisit, re-examine and to recalibrate their expectations of where value from outsourcing is truly created.